Comprehensive Mobile Strategy Drives Competitive Advantage

/

Since the release of the first iPhone and App store in 2008, there has been an ongoing debate about the Open vs. Closed Web and which will ultimately win out. Almost four years ago (August 2010) Wired published a view that “The Web is Dead”. Those in the Search marketing space joined with Google in taking the other side that the Open Web will prevail.

We don’t view this in terms of binary winners, however, but rather a debate about the direction of user behavior and the resulting marketing and competitive implications. The way we see it, the last four years have shown us that while the Open Web and Search continue to drive trial and customer acquisition (which is incredibly important), the Closed Web, and mobile apps specifically, is key to user dialogue, frequency and loyalty. The winners will be the first to master both the Open and Closed Web. We see this already in Travel, where Online Travel Agents have demonstrated the keen ability to marry both sides of this mobile world for competitive advantage and to grow their share of e-commerce bookings.

In this post, we will examine both sides of the argument, but then show how they are really two sides of the same coin.

Apps Offer a Superlative User Experience

The following chart shows users prefer Apps. Apps offer a faster, simpler and personalized UX. This utility increases for logged in users due to easy form filling, more relevant content and access to user data.

The fantastic UX that apps can offer through convenience and reduction of service friction has launched a new category of App-based businesses: “On-demand mobile services”. When their apps are superlative, some of these new brands have become successful very quickly. Uber and HotelTonight are leading examples – so successful, in fact, that they can upend traditional Search for specific needs. This point of view is shared by Cathy Boyle, a senior mobile analyst at eMarketer, who says “Search engines are not necessarily the first place smartphone and tablet users turn. The explosion of mobile app development and usage means mobile users have more – and more specialized – alternatives for finding information.”

At DMW, we believe that app design, technology, marketing, and data are becoming an important combined factor in certain M&A activities, including last week’s announcement that Priceline is buying OpenTable and last year's acquisition of Kayak.

Mobile Browsers Drive Convenience & Discoverability

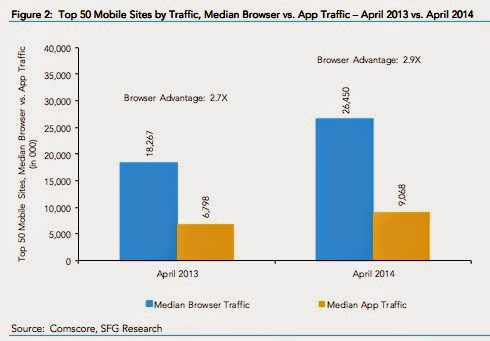

Despite the better UX of apps and users’ preference for them, we see from this chart that mobile web traffic out-paces mobile app traffic 3:1.

|

| Mobile browser traffic vs. app traffic for top 50 mobile sites |

This is all relatively common knowledge, of course, but is usually used to play one side of the Open vs. Closed argument or the other. DMW’s point of view, however, is that this is not a mutually exclusive (nor permanent) decision for users. We believe this 3:1 ratio to be a very clear demonstration of a typical agnostic / loyalist customer mix. The 3:1 traffic ratio implies an average 33% retention rate, which is reasonable. Our takeaway: Businesses most adept at leveraging both the open AND closed web will win.

Indexed Travel App Ratings

To help further understand opportunities for travel brands, DMW studied customer ratings of apps (in Google Play and Apple Store) and indexed OTAs (7), Metasearch sites (5) and Suppliers (9) against the entire group. Our findings have further informed our “open + closed” strategy. The headline is that OTAs and Metas index at 105 and 104, while Suppliers index at 92.

Highlights - OTAs and Metas:

- The Rating range for OTA and Meta is quite small indicating 1) inherent value through scope/choice and 2) e-commerce businesses: they get it (strategy, management, culture, resource allocation, etc.)

- Scale Advantage -- In the travel vertical, users find much more utility with OTAs and Meta apps due to the scope of services offered versus hotel or flight only apps. Not surprisingly, TripAdvisor, offering the most choice, content and reviews, is the download king with an estimated 100 million downloads

- DMW Takeaway: How you market the App will also determine how quickly you can scale downloads. There are organic (free) and paid (sponsored) methods that are emerging be best practices.

- DMW Takeaway #2: We expect PCLN to leverage the OPENTABLE app downloads with Kayak, Priceline and Booking apps to gain further scale advantages. It will be interesting to watch this potential synergy unfold over the next few years.

Highlights - Suppliers:

- Among the supplier brands, the range in index scores, from 77 to 109, is much greater than the OTAs and Metas.

- Kudos to Starwood SPG for their 109 Index (4.3 stars) and the booby prize goes to Hyatt (77 Index, 3 stars).

- DMW Takeaway: The enormous variance in app ratings for hotel brands is due neither to the strength nor size of their loyalty programs. Example: Marriott ranks towards the bottom but has the largest loyalty program. What drives better ratings is a combination of better strategy and resource allocation, along with the expertise to design, build and market a superior app experience.

Advice for Suppliers: Strategize for the Virtuous Cycle

Suppliers who are looking to get ahead must factor in the CPA of bookings made through apps vs through third parties: Bookings made through apps are akin to bookings from direct website visits in terms of margins – the CPA is very low (need to factor in install and app marketing costs, subject of future post). Aggressive brands will understand that ROI calculations for an improved app experience must include these higher margins as guests channel shift (in reasonable numbers) from intermediaries to the direct channel.

In turn, the combination of great UX, scope, and scale is a power play that creates a virtuous cycle of more downloads, usage, and profits -- which fuels greater investment in the app platform and marketing. This virtuous cycle quickly becomes a competitive advantage: you will find more frequent updates and improved UX with app winners such as Booking.com and TripAdvisor.

What to Expect?

We expect this intermediary app advantage to enable further indirect e-commerce share gains over direct e-commerce. OTAs and Metas will leverage these advantages to grow more traveler wallet share -- which will drive greater reach, downloads, investment in better updates and less hotel brand loyalty. Unless the fragmented hotel industry (brands, owners, franchisees) starts allocating much more capital to this important area, they will continue to lose online revenue share.

Google has begun building a massive database of app pages and this will be very important going forward. It will enable app marketers to leverage “pull marketing” through Google Search and “push marketing” through Google Now, Google Maps, and other Google apps. The major OTAs and Metas are seeing their percent of traffic and bookings from Google decrease as a result. The intermediaries’ traffic level from Google is down to 10-12% versus the hotel Brands with Google contributions over 20%.

What do you think about Mobile and App marketing? Are we on the verge on of a new marketing frontier? DMW would love to hear your comments below.

By Jack Feuer -- Founder & President, Digital Marketing Works