Guest Review Optimization Drives Hotel Market Share

/

A new research paper from The Center for Hospitality Research has been getting a lot of attention for proving, with hard numbers, the positive impact of online reviews

upon hotel performance. The paper, by Chris K. Anderson, is full of important metrics that

we will highlight in a moment, but I’d like to start with this quote:

“In terms of the hotel choice process… the tipping point [for the relevance of reviews] came in 2010… At this point, the guest experience mentioned in customer reviews became the dominant factor in hotel selection.”

At DMW, we have been “review evangelists” since about that time, in early 2010, when we first identified this trend and began to explore it

aggressively with our clients. We have conducted client-side studies with data

sets of up to 700 limited service hotels and have had significant hands-on experience

with high-end resorts and urban hotels as well. I also do an annual

tour of the review monitoring tools that are available to hotels in North

America and Europe.

|

| Internal Presentation to DMW Clients from Q2 2010. |

To say the least, we are excited that a study like this, which requires many disparate data points, has finally come together. Here’s a few highlights for those who haven’t read the paper:

- The percentage of consumers consulting reviews at TripAdvisor prior to booking via a hotel's website has increased from 28% in 2008 to 36% in 2010. The quantity of reviews they are reading has gone up, too.

- An increase in review scores by 1 point on a 5-point scale allow a hotel to increase its rate by 11.2% while maintaining the same occupancy or market share

- A 1% increase in a mid-scale hotel’s online reputation score leads up to a 0.89% increase in ADR, an occupancy increase of up to 0.54%, and up to a 1.42% increase in RevPAR

- This effect is greatest for economy and limited services hotels and least for luxury properties

Mr. Anderson's findings are very consistent with what we've known and intuited for some time, but how do we act upon these findings? And, how do things change when we step out of the professor's office and into the GM's office? Today, I'll take a look at three key takeaways from the paper and share the DMW point of view.

1. Reviews Matter More for Limited Services Hotels vs. Luxury (If You Don't Count On-site Spend)

Some reactions to this paper sum it up with the finding that the impact of online reputation upon performance increases as hotels move down from the "luxury" class. Here's a chart from the study:

|

| "GRI Elasticity", by Chris K. Anderson of The Center for Hospitality Research |

Although not in the table above, Mr. Anderson shared with us via email that the trend is even stronger still for limited service and economy hotels. (He excluded this data because his sample size for the study was too small to include.)

DMW's Point of View: While this is a very significant finding (especially for limited service hotels), luxury hoteliers should not walk away with the conclusion that "reviews matter less" for them. On the contrary, we simply need to consider reviews in a different context, one that considers the behavior of checked-in guests and their overall spend while at the resort.

Ratings and reviews

have significant potential to increase the onsite-spend of luxury hotel guests. Positive reviews for individual amenities (bars, restaurants, spas, golf, etc) drive guest usage and, therefore, overall per-guest revenue. Just as 2010 was the tipping point for hotel-level reviews, we will soon reach a similar tipping point for individual activities, beaches, pools, and more. Along with hotel-level reviews, luxury hoteliers should focus here if they want to stay ahead of the curve.

2. TripAdvisor is Still the Review King (But Watch Out For Google)

With good reason, Mr. Anderson's study focused on TripAdvisor reviews and Travelocity. Although studies from PhoCusWright show that TripAdvisor has lost market share to other review platforms, it still easily reigns supreme in this space. As a result, many hoteliers could make the reasonable assumption that they should put all of their review eggs in one TripAdvisor basket. TripAdvisor feeds this by providing their branded badges, widgets, and business cards to hotels -- all of which drive more reviews to TripAdvisor.

DMW Point of View: We have talked a lot lately about the big changes to Google's search algorithms and the race to win what we have dubbed "The Walk-in Economy" via local search. Google places an increasing amount of emphasis on reviews for its organic search algorithms and within its HotelFinder product, which has just recently jumped from "experiment" status to a global multi-language service that will become a major factor in online distribution.

Thoughts for economy and limited service hotels: A good review presence in Google is important for hotels in this class because such models usually include a large mix of walk-in business. Walk-in business is substantially driven by mobile. If you want to be found on phones, especially via Google, then you must have good reviews, and lots of them. If not, Google's algorithm will demote you off the first page.

Thoughts for luxury hotels: Google is the perfect home for the activity-level reviews that I described in point #1, above. The rapid adoption of mobile usage drives behavior to "search nearby" and to check in to (and review) increasingly small/obscure places (like specific beach cabanas or a specific swimming pool). Driving reviews of these activities provides utility to your guests and provides a second level of search optimization for your hotel.

Our actionable advice: Savvy hoteliers who encourage guests to leave reviews on Google will kill two birds with one stone: 1) Achieving all of the performance benefits described by Mr. Anderson, and 2) Improving Google organic and HotelFinder search rank.

Thoughts for luxury hotels: Google is the perfect home for the activity-level reviews that I described in point #1, above. The rapid adoption of mobile usage drives behavior to "search nearby" and to check in to (and review) increasingly small/obscure places (like specific beach cabanas or a specific swimming pool). Driving reviews of these activities provides utility to your guests and provides a second level of search optimization for your hotel.

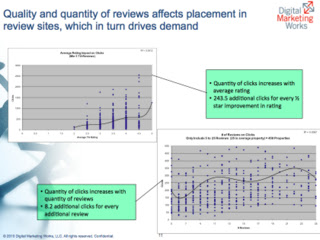

3. Increasing Your Review Scores by "X" Results in "Y" (If You're The Only Hotel in Town)

The study correlated improved reputation scores with the ability to raise rates while maintaining market share:

"If a hotel increases its review scores by 1 point on a 5-point scale (e.g., from 3.3 to 4.3), the hotel can increase its price by 11.2 percent and still maintain the same occupancy or market share."

DMW Point of View: In a static academic study, this is completely valid, but in a live

business environment, this gain must be achieved versus the competition, who (we

should assume) have also been reading up on reviews and are also trying to

improve their scores! The "versus the competition" element can make this task substantially more challenging.

For hotels to have a real shot at achieving this goal, they must focus on the right metric. ReviewPro’s GRI score (a key data point in much of this study) is good, but inadequate because it looks at a hotel’s score in isolation. The best score is a Compset Index. A Compset Index compares your hotel’s scores (say, a rating of 4.5 out of 5 stars) to your competition (usually as defined in your STR reports). Example: 4.5 seems like a good score, but if your local competition has an average score of 4.6, then you’re at the bottom of the pile.

Note: Portions of Mr. Anderson's study do rely on index scores, specifically those related to ADR, RevPAR, and occupancy. In either case, hoteliers must understand that it is the compset index score that matters, not the raw scores of their hotels in isolation.

Note: Portions of Mr. Anderson's study do rely on index scores, specifically those related to ADR, RevPAR, and occupancy. In either case, hoteliers must understand that it is the compset index score that matters, not the raw scores of their hotels in isolation.

Our Actionable Advice: Some review monitoring tools, including Revinate, have a compset score. Use it to focus on the quality of scores (ie: 1 - 5 stars), the quantity of reviews (how many reviews total), and the frequency of reviews (reviews per week). In all cases, these should be compset metrics that compare you to the hotels down the block. Improving these metrics are the collective key to optimizing your hotel for organic search in Google and any OTA or review site where your hotel is listed.

What's Next?

As always, please share your thoughts in the comments below and share this post with others.