Travel Industry Analysis: Google Acquires Frommer’s (and Zagat)

/

Google has had a habit lately of making the travel industry weak in the knees. In relatively quick succession, the

acquisitions of ITA, Zagat, and Frommer’s Travel Guides have caused currents of

fear, confusion, and optimism – depending on where you stand within the travel

ecosystem.

Analysts seem to be viewing Google’s latest acquisition of Frommer’s as a solution “to its Yelp and TripAdvisor problem”. While I agree with this assessment on the

surface, I think there are broader motivating factors at Google than competition with TripAdvisor. What follows is

my humble attempt to divine the thought process that is driving Google's acquisitions and to put their recent maneuvers in the context of key takeaways for brands.

First: Let’s remind ourselves of a few of Google’s corporate guiding

principles (skipping over the “do no evil” stuff). Here’s my take:

- Organize the world’s information

- Provide the most useful --the most actionable-- data to users

- Ensure that Google is available in all platforms, devices, and mediums. Especially mobile. Especially voice search.

My take: Google knows that it is no longer sufficient to

blindly direct users to existing content. The results are not always

“actionable” enough. And when the content is not actionable enough, the utility

of Google itself diminishes. In response, Google has developed strategies to subtly coach

the public and brands on providing content that others will find useful and

actionable. When these strategies succeed, results can include:

- Improvement in the quality of search results, and therefore overall usage of Google

- More interaction with the target content. That is, more comments, reviews, photos, videos, and other UGC.

Putting Zagat and Frommer's in a Larger Context

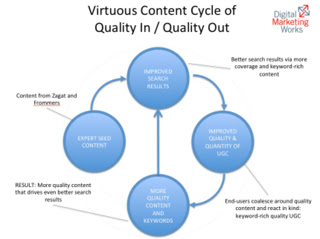

Now, let’s look at Zagat and Frommer's. These two publishers are superb sources of content. In terms of “quantity”, they bring reviews of millions of venues. In terms of “quality” they provide sticky keyword-rich content. This excellent content is at the heart of what I’ve dubbed a “Quality In / Quality Out” strategy.

A modern spin on the programmer’s traditional “GIGO”, Quality In / Quality Out tells us that very good content functions

like a “seed crystal”. It undoubtedly encourages more UGC reviews of

higher (ie: accurate and keyword rich) quality.

Quality content also provides a deeper set of keywords against which

searches can be conducted. The end result

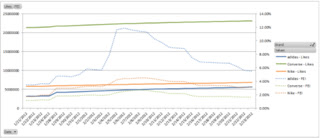

is a virtuous cycle of quality content / better search results / interactivity / more quality

content. This diagram sums it up nicely:

What This Means to You and Your Brand

Google's Panda and Penguin updates have shaken up brands and businesses of all sizes. It now seems that Google, too, must bow to the

demands of its new algorithms. This post has examined Google’s own quest for quality

fresh content. Sound familiar? For most brands, it should. Google is now using some of the same strategies as brands to optimize its performance. It means that your existing best strategies are becoming even more relevant:

- Focus on “Content Performance” strategies. Example: As new Zagat and Frommer's content comes online, look up your own brands and venues. Use the refreshed "At a glance" keywords in your own outgoing content.

- Encourage Employee Generated Content and User Generated Content

- Collaborate with professional bloggers to create seeds of quality content around which consumer content will crystallize in the form of reviews, comments, and photo/video

- Assume that Google will become even more relevant and actionable than it is today. Encourage customer reviews on Google.

The same Quality In / Quality Out concept could be applied to ITA, Motorola, and

YouTube (look for integration with Google+ soon). Looking forward to further

exploring those concepts in a later post...