How to Use FEI to Measure Content Performance

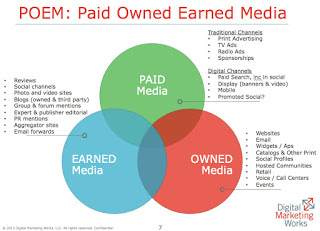

/Engaging content in Facebook matters more than ever, in particular as Apple announced full integration with Facebook in IOS6. Use DMW's Facebook Engagement Index as a shortcut to measuring Content Performance.

Facebook: How Should Hotels Measure Success?

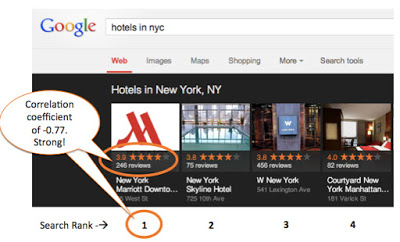

Justin Reid’s Tnooz

last week was right on the money: Stop obsessing over Facebook Likes – it’s not the right metric. I agree that bringing more attention to “Were Here” is the right idea for hotels, but I would also suggest that it’s not the only right metric. Hospitality is a vertical that has a natural abundance of good, relevant content, and engaging content matters! It matters because good Facebook content –when done right-- drives traffic to a hotel’s website, which in turn drives revenue. If you accept this, your next question might be: “So how do you define content as “more engaging” or “less engaging”? Good question...

The Challenge: Facebook does not make it easy to measure “engagement”

When you download your Insights data, Facebook provides a workbook with an unbelievable 70 tabs’ worth of data. For those of us who have trouble finding the signal in all that noise, Facebook also offers something at the other extreme: their single metric called “People talking about this” -- a “kitchen sink” collection of all social activity in Facebook boiled down into one easy-to-understand number. Perfect for monitoring overall “engagement”, right?

Well, not quite. The problem with Talking About This, like most other metrics in Facebook, is that it is a raw quantity. This presents two specific challenges:

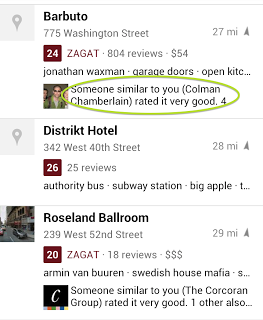

It’s hard to compare brands or competitors of differently sized fan bases: This means that bigger hotels, like The Atlantis, will always have much larger “Talking about this” scores that more modestly-sized resorts and hotels. Does this mean that The Atlantis is more engaging than, say, South Seas Island Resort? Not necessarily, it simply means that they are talking to more people – it means that they are broadcasting better, but not necessarily engaging better.

It’s hard to compare content performance between two time periods like year-over-year or month-over-month: “Talking about this” would be fine if we consistently worked with the same quantity of followers, but we don’t; the fan-base (or like-base) of brands is always growing because the use of Facebook itself is always growing. In other words, even brands that hardly try will see their fan bases increase and, as a result, their “Talking About This” number grow. Does this mean that a brand is more engaging than it was this time last year? Again, no. It simply means that the brand is talking at more people.

The Solution: Use The Facebook Engagement Index (FEI)

In a nutshell, we need a universal metric for engagement performance that remains consistent for fan-bases of any size.

Digital Marketing Works developed the

(FEI) to meet this need. It provides a simple value that allows an apples-to-apples comparison of brands, regardless of their size. This value remains consistent over time, enabling real YoY and MoM comparisons of social “content performance”. FEI is one of the few, if not the only, services that allows you to measure the true quality and quantity of your Facebook presence.

FEI currently tracks about 700 Travel and Hospitality brands and about 300 of the best-known bar and restaurant franchises in North America. More brands are being added each day. If you don’t see your hotel listed,

! The service is free and built from publicly available Facebook data.

Tactical: Use FEI to Support Your Social Strategy

If you have bought into the value of tracking the true engagement of your Facebook page, it’s time to put FEI to work for you. Here’s a few starting points…

The best strategy is one that supports quantity and quality. Use FEI to chart the growth of your fan base while trying to keep your quality score –your FEI score— on level. For a great example see our same client, Center Parcs UK here: http://goo.gl/DrXuD

Your Social team can rely on FEI as a simple metric to chart the effectiveness of their content. It’s also an easy-to-understand value that translates for Management.

All ships rise at high tide. We see it with STR report numbers like occupancy index, and we see it with FEI numbers, too. Set up a compset report to compare yourself to your competitors or what you consider to be aspirational brands.

What We Have Learned so Far

We've been monitoring FEI scores for about two years and beta launched Facebook Engagement Index in Q1 of this year. Here are some of the highlights of what we have learned so far...

Good news for hospitality! Hotel and Travel/Leisure brands are among the most engaging category in Facebook, taking the number 2 and 3 positions after the “Local Business” (see above chart below for more)

Most brands get into double-digit FEI scores only occasionally – usually when running a competition or (we hope) when they are generating authentically useful or entertaining content.

In nearly all cases, bigger brands have lower engagement, as measured by FEI.

Spikes in FEI scores correlate with spikes in traffic to branded websites and a lift in reservations. We recently were able to document this with our client, Center Parcs UK (see below)

DMW and our clients continue to be surprised by what we are learning from FEI.

today and share what you learn with us!

Jack Feuer, founder of DMW, will be speaking at the EyeForTravel conference in Las Vegas this Friday and would be happy to discuss FEI with you. He will be participating in the Interactive Debate: Thrive in the Travel Search Diaspora at 11:00am PT.